The magnitude of overlapping shipping disruptions

For the first time, the world faces simultaneous disruptions in two major global maritime trade waterways, with far-reaching implications for inflation and food and energy security.

Since November 2023, escalating attacks on ships in the Red Sea have been compounding disruptions in the Black Sea caused by the war in Ukraine and in the Panama Canal due to climate-induced droughts.

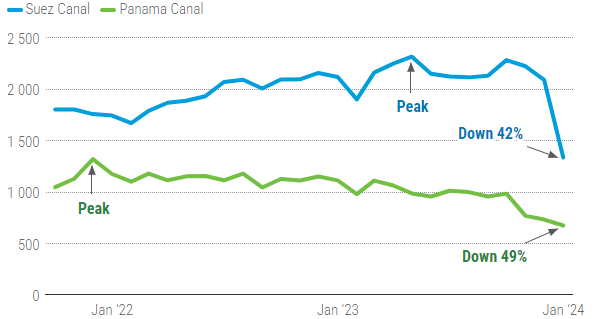

The drop in monthly transits underscores the magnitude of overlapping shipping disruptions.

In both the Suez and Panama canals, transits are down by more than 40% compared to their peaks. Most of the decline in the Suez Canal occurred over the last two months, while transits through the Panama Canal have been decreasing over the last two years.

Transits almost cut in half in the two international canals

The Suez Canal enables a more direct route for shipping between Europe and Asia, without having to circumnavigate the African continent.

In 2023, approximately 22% of global seaborne container trade passed through the canal1, carrying goods including natural gas, oil, cars, raw materials and many manufactured products and industry components to and from the Indian Ocean, the Mediterranean Sea and the Atlantic Ocean.

Given the risk of attack in the Red Sea, many ships are now avoiding the canal, opting for a longer route around Africa. By the first half of February 2024, 586 container vessels had been rerouted2, while container tonnage crossing the canal fell by 82%

Shift in container shipping routes from the Suez Canal to the Cape of Good Hope

Container vessels above 13500 20-foot equivalent units (TEU), 1 December 2023–15 February 2024

Climate-induced drought disrupts the Panama Canal

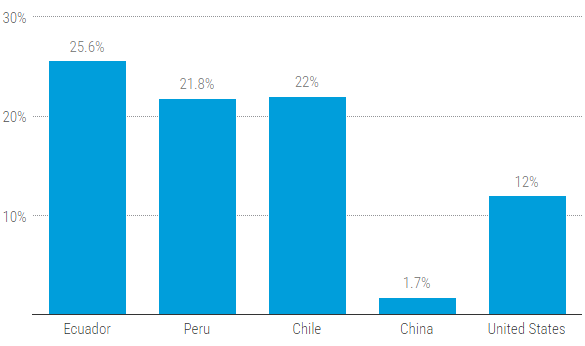

Facing alarmingly low water levels, the Panama Canal Authority has reduced daily transits from an average of 36 to 22, with plans for further reductions to 18 per day by February 2024. The Panama Canal is particularly important for countries on the West Coast of South America.

Importance of Panama Canal for selected countries

Share of trade volume, in tons, going through the Panama Canal, 2021

To avoid long waiting times, vessels were rerouted through the Suez Canal for cargo originating from Asia, increasing Suez transits before the current Red Sea crisis. The disruptions in the Panama Canal have increased demand for rail and road transport services in recent weeks, as shippers no longer have the option of rerouting through the Suez Canal.

Red Sea and Suez Canals interrupted: Impacts and implications

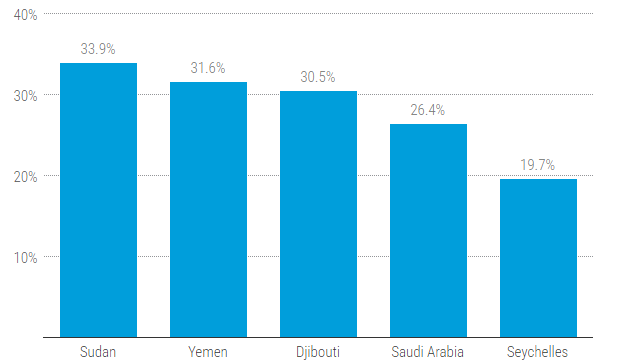

The Suez Canal is a major source of foreign currency revenue for Egypt, contributing $9.4 billion in the fiscal year 2022/23, about 2.3% of the country’s GDP. The Red Sea crisis has reportedly triggered a 40% drop in Suez Canal revenues3. A deteriorating situation in Egypt could have negative spillover effects for other countries in the region, such as Ethiopia and the Sudan.

Importance of Suez Canal for selected countries

Note: The Suez Canal does not publish transit statistics based on countries of origin or destination. UNCTAD estimated the shares of foreign trade volumes that pass through the Suez Canal, based on origin and destination trade data (by volume, not value) sourced from MDS Transmodal. The estimated shares are for total foreign trade and not only maritime.Source: UNCTAD calculations, based on data from MDS Transmodal Get the dataDownload image

Ship rerouting increases distances and shifts operations

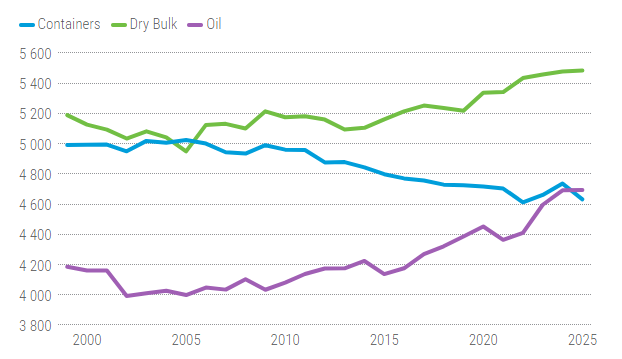

The war in Ukraine has exacerbated the trend of increasing distances for maritime cargo, particularly for the oil and grain trades.5

In other shipping markets, more oil tankers are now also rerouting through the Cape of Good Hope. The number of specialized car-carrying ships using the Red Sea dropped by more than half in December 2023 compared with December 2022. And practically no liquified natural-gas carrying vessels are currently using the Suez Canal, causing a spike in gas prices.

Distances go up due to Black Sea, Red Sea and Panama Canal disruptions

Note: 2024 and 2025 are forecasts

Source: UNCTAD, based on data from Clarksons Research. Get the dataDownload image

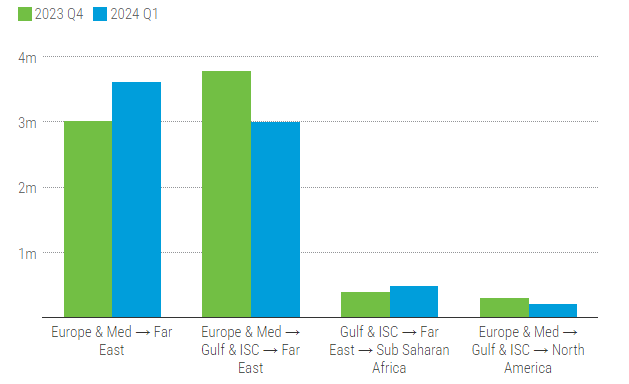

The latest data for the first quarter of 2024 shows how container shipping capacity is being redeployed away from Gulf countries and introducing more services, including from and to Africa.

Companies are rerouting their ships to avoid the Middle East

Note: The figure presents selected routes, where a significant percentage change in fleet deployment is seen.Source: UNCTAD calculations, based on data from MDS Transmodal. Get the dataDownload image

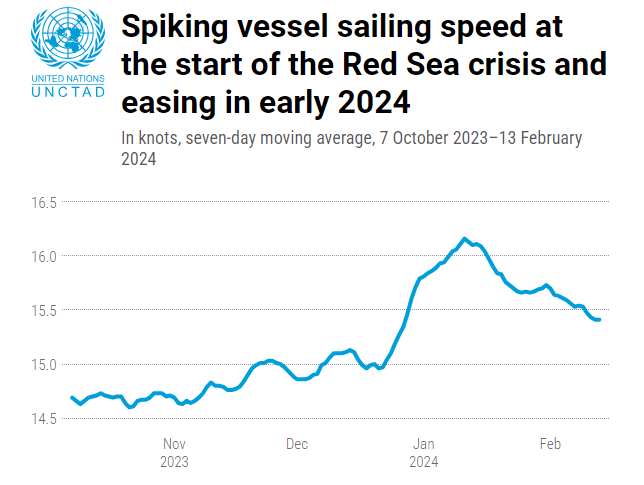

Vessel speed and carbon emissions increase

The disruption in the Red Sea and Suez Canal, combined with factors linked to the Panama Canal and the Black Sea, could erode the environmental gains achieved through “slow steaming”, as rerouted vessels increase speeds to cover longer distances.

This is particularly evident among container ships, where a 1% increase in speed typically leads to a 2.2% rise in fuel consumption. For example, accelerating from 14 to 16 knots increases fuel use per mile by 31%.

As a result, the longer distances caused by rerouting from the Suez Canal to the Cape of Good Hope imply a 70% increase in greenhouse gas emissions for a round trip from Singapore to Northern Europe.

Spiking vessel sailing speed at the start of the Red Sea crisis and easing in early 2024

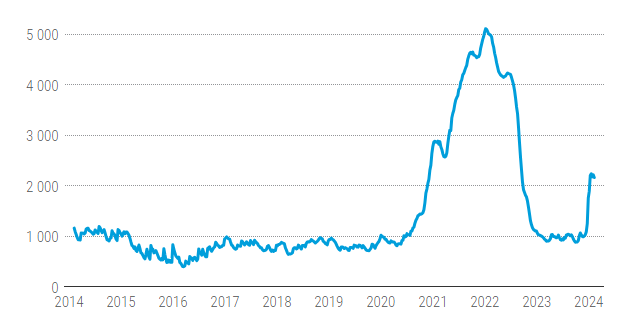

Shipping costs and rates surge

Impacts on freight rates have varied across market segments, with container shipping handling consumer and manufactured goods facing the sharpest increases.

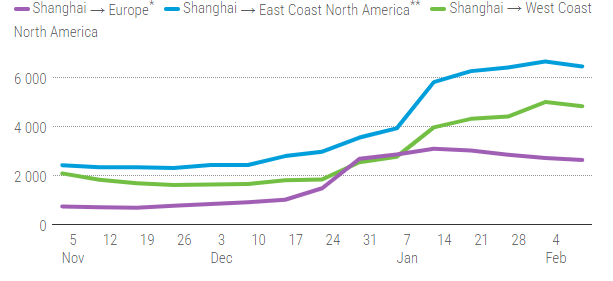

Container freight rates on Asia–Pacific to Europe routes have risen sharply since November 2023. A record weekly spike of $500 was observed in the last week of December 2023. Average container shipping spot rates from Shanghai in early February 2024 more than doubled – up by 122% compared to early December 2023. The rates from Shanghai to Europe more than tripled, jumping by 256%.

Container freight rates are on the rise again

SCFI Comprehensive Container Freight Rate Index, 7 February 2014–9 February 2024, dollars per container per shipment

Source: UNCTAD calculations, based on Clarksons Research and https://en.sse.net.cn/indices/scfinew.jsp. Get the dataDownload image

While freight rate increases have been relatively higher on routes crossing the Suez, the repercussions extend to distant locations, such as routes linking Asia to the United States West Coast, where rates have surged by 130% since early November. The West Coast provides an alternative route using rail to reach destinations in central and eastern United States.

Meanwhile, freight rates to other destinations have seen lower increases.

Freight on the Suez Canal route sees the highest surge in rates

Spot freight rates from Shanghai, selected routes, per 20-foot equivalent unit (TEU), dollars

Shanghai → Europe*Shanghai → East Coast North America**Shanghai → West Coast North America

Note: *Route goes normally through the Suez Canal. ** Route goes normally through the Suez Canal or the Panama CanalSource: UNCTAD calculations, based on data from Clarksons Research and https://en.sse.net.cn/indices/scfinew.jsp

Way forward

While the combined impact of these disruptions has not yet matched the scale of the pandemic-induced logistical crisis of 2021–2022, UNCTAD is closely monitoring the situation.

The war in Ukraine has already shown how longer distances and higher freight rates can affect food prices.

Going forward, it will be important to continue to monitor key developments and assess their potential implications for transport and trade, especially for developing countries. Key issues to track include shipping schedules and service reliability, security measures for ships and ports, delays in shipments and delivery timelines, increased freight rates and insurance premiums, shipping connectivity and the overall geography of trade.