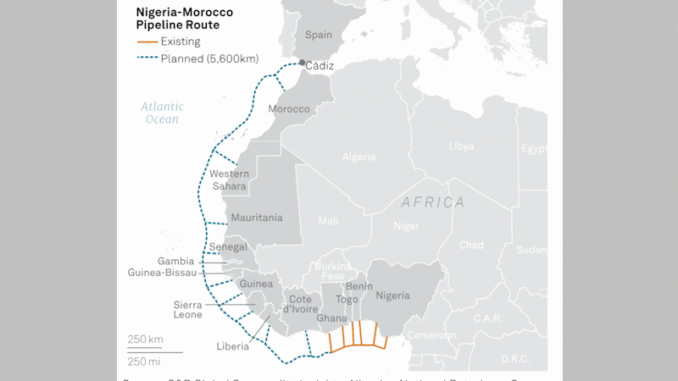

The subsea Africa Atlantic Gas Pipeline (AAGP) would cross 5700km of seabed traversing 11 countries to connect Nigeria to Morocco. According to Morocco’s state-owned energy company, ONHYM, the pipeline would have a nameplate capacity 30 billion cubic meters (bcm) of natural gas per year.

Morocco likes big. Big is good. In 1987, cooks in Agadir made the world’s biggest couscous. In 1993, it built the world’s biggest minaret and the world’s biggest concentrated solar power plant in 2016. The world’s biggest soccer stadium is currently under construction in Casablanca. And Morocco wants to build the world’s longest submarine natural gas pipeline.

The subsea Africa Atlantic Gas Pipeline (AAGP) would cross 5700km of seabed traversing 11 countries to connect Nigeria to Morocco. According to Morocco’s state-owned energy company, ONHYM, the pipeline would have a nameplate capacity 30 billion cubic meters (bcm) of natural gas per year. ONHYM claims the pipeline’s gas would provide electricity to West Africa, thereby fostering regional economic development and regional stability. In addition, it would export up to 18bcm/year from Morocco to Europe, transforming Morocco into an energy hub for Europe.

But the AAGP would be a big and vain white elephant.

Morocco wants to build the world’s longest submarine natural gas pipeline (5700km!), connecting Nigeria to Morocco, via 11 countries. According to ONHYM and the Ministry of Energy Transition, the pipeline would provide energy access to 400 million (!) people. And it would transform Morocco into an energy hub for Europe.

The Africa Atlantic Gas Pipeline would have a nameplate capacity of 30bcm/yr. 18bcm/yr would be exported from Morocco to Europe via the GME.

Okay! Pretty cool. But lets take a closer look. First, about that 400 million. Where’d that come from?

Well, if you add up the populations of Nigeria, Benin, Togo, Ghana, Cote d’Ivoire, Liberia, Sierra Leone, Guinea, Guinea Bissau, Gambia, Senegal, Mauritania and Morocco.

What do you get? A little more than 400 million. Rigorous studies. But including Nigeria doesn’t make any sense. That’s where the gas is coming from…

So, let’s subtract that population. You end up with a more manageable 170 million. But even then, that’s assuming an electrification rate of 0%. But it’s not like AFRICA! doesn’t have electricity already.

If you factor in existing electrification rates, the real number of people that would presumably benefit from the Africa Atlantic Gas Pipeline is closer to 40 million.

Providing energy access to 40 million people is no doubt worth it. But the pipeline will be built in stages.

Stage 1 is Morocco, Mauritania, Senegal. But Senegal and Mauritania are ALREADY gas exporters, via LNG vessels. They don’t need a pipeline. They just don’t.

The Africa Atlantic Gas Pipeline’s Phase 3 plugs into the West Africa Gas Pipeline (WAGP) linking Nigeria to Ghana. But 94% of Ghana’s gas supply mix now comes from Ghana’s own gas. It doesn’t need the WAGP and it doesn’t need the Africa Atlantic Pipeline.

Then there’s the question of volumes – how much gas goes where.

Assuming that the pipeline will achieve nameplate capacity of 30bcm/yr (and that’s a BIG assumption,) each of the 11 transit countries will take a payment in kind. Probably around 5% of the volume of gas in the pipeline crossing their territory. That means only about 15bcm/yr will actually reach Morocco

Morocco will need about 3bcm/yr to meet its own electricity needs by 2040. So that leaves about 12bcm/yr to export to Europe or about 25% of what Algeria already exports via pipelines (ie excluding LNG). And that’s assuming that 30bcm/yr actually leaves Nigeria. Which it won’t. The volume will be a lot less.

But pipeline’s aren’t free. And the Africa Atlantic Gas Pipeline’s projected cost is a whopping US$ 25 billion (assuming NO cost overruns…)

And at some point, investors want to make their money back and starting making a profit. But about half of the Africa Atlantic Gas Pipeline’s volume is lost as payments in kind to transit countries. Only about 10-12bcm/yr will go to paying customers.

So, how will it make money? Algeria’s Medgaz is a good example. It also pumps 12bcm/yr to Spain. Medgaz cost US$ 1.4 billion. It was commissioned in 2009. Cost recovery took 12 years.

The Africa Atlantic Gas Pipeline will cost at least 25x Medgaz. But it will carry the same volume of gas. All things being equal then, the Africa Atlantic Gas Pipeline would not recover initial capital expenditures for…

Source: Morocco Mail