Despite a slowdown in the shipbuilding market in 2025, liquefied natural gas confirms its dominance in the tanker sector. Data from DNV’s Alternative Fuels Insight (AFI) platform reveals remarkable resilience, driven by shipowners committed to decarbonizing their fleets and growing confidence in supply chains.

The year 2025 marked a turning point for the shipbuilding sector. After a period of strong growth in 2024, the market experienced a significant slowdown, reflecting regulatory uncertainty and a readjustment of business strategies. The total number of new ship orders fell by more than 40%, from 4,405 in 2024 to 2,403 in 2025.

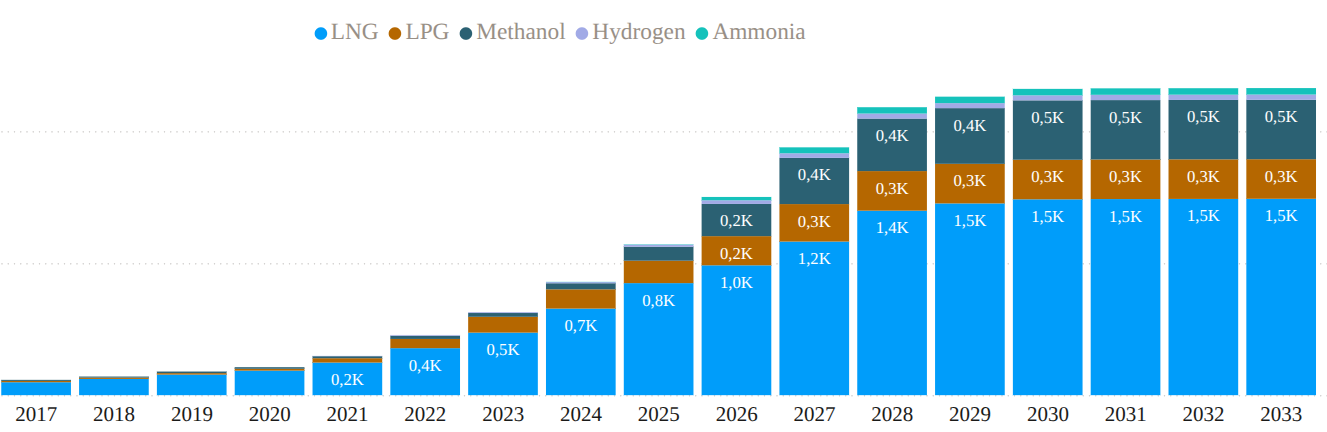

However, despite this overall decline, the share of ships running on alternative fuels remained stable, representing 38% of the gross tonnage ordered. This stability is a testament to a sustained commitment on the part of shipowners to the maritime energy transition. According to Knut Ørbeck-Nilssen, Managing Director of the maritime sector at DNV, this slowdown also reflects « a natural decrease after several years of exceptional order activity« . Nevertheless, he stressed that « in some segments, the momentum in favor of alternative fuels remains« . Number of new alternative fuel vessels per year. © DNV – AFI 2026

Number of new alternative fuel vessels per year. © DNV – AFI 2026

Containers, undisputed bastion of LNG

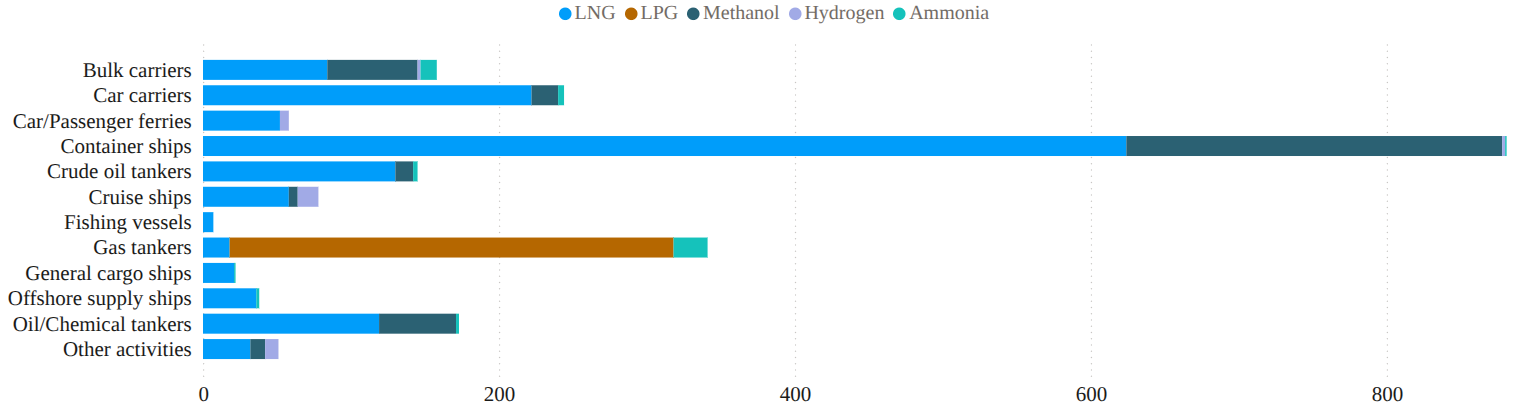

The container carrier sector, in particular, has demonstrated impressive resilience to the general slowdown. With 547 new orders in 2025, it even surpassed the 2024 figure (447 ships). This segment alone accounts for almost half of the total gross tonnage ordered and 68% of new orders for alternative fuel vessels. Number of new alternative fuel vessels by type © DNV – AFI 2026

Number of new alternative fuel vessels by type © DNV – AFI 2026

Within this strategic segment, LNG reigns supreme. It represents about 58% of the tonnage, far ahead of conventional fuels (36%) and methanol (6%). This dominance reflects the confidence of shipowners in LNG as a mature and available solution for the decarbonization of maritime container transport. Chargers, faced with increasingly ambitious emission reduction targets, favor investments where there is « strong convergence between fuel infrastructure, regulatory certainty and commercial viability, » explains Jason Stefanatos, Global Director of Decarbonization at DNV.

LNG largely dominates, methanol in decline

On all types of vessels, LNG dominated the alternative fuel market in 2025 with 188 orders, accounting for 31% of total gross tonnage. On the other hand, methanol, after a euphoric year 2024, saw its orders collapse, from 149 to 61. Orders for ammonia or LPG ships still remain anecdotal.

This trend reflects the maturity of the LNG supply chain and the growing customer demand for more environmentally friendly transportation. LNG tankers, once drivers of the transition, also recorded a 73% decline between 2024 and 2025. Similarly, bulk carriers, oil and chemical suppliers have all experienced marked declines, demonstrating a constant priority given to cost reduction and less immediate interest in the adoption of alternative fuels in these segments less sensitive to loader pressures.

Investments in infrastructure reassure about the future

Confidence in LNG is also visible in investments related to sub-souting infrastructure. In 2025, 22 new LNG supply ships were ordered, supplemented by new ships capable of supplying methanol and biofuels. These developments significantly strengthen the LNG supply chain and reduce the operational risks associated with the adoption of this fuel.

These investments in specialized tankers are a key element in promoting the economic viability of LNG vessels and securing shipowners’ investments.

source : gaz-mobilite