At the start of 2026, container shipping is balancing between cautious optimism and operational realities regarding a potential return to the Red Sea and the Suez Canal. While some signs indicate a shift in carrier behavior, Xeneta warns that a widespread return to traditional routes remains uncertain and could trigger significant turbulence in freight rates if rushed.

In an analysis published on December 23, 2025, Xeneta described 2026 as a transitional year rather than a return to normal. Since then, new data and carrier announcements have enriched this perspective—without dispelling major uncertainties.

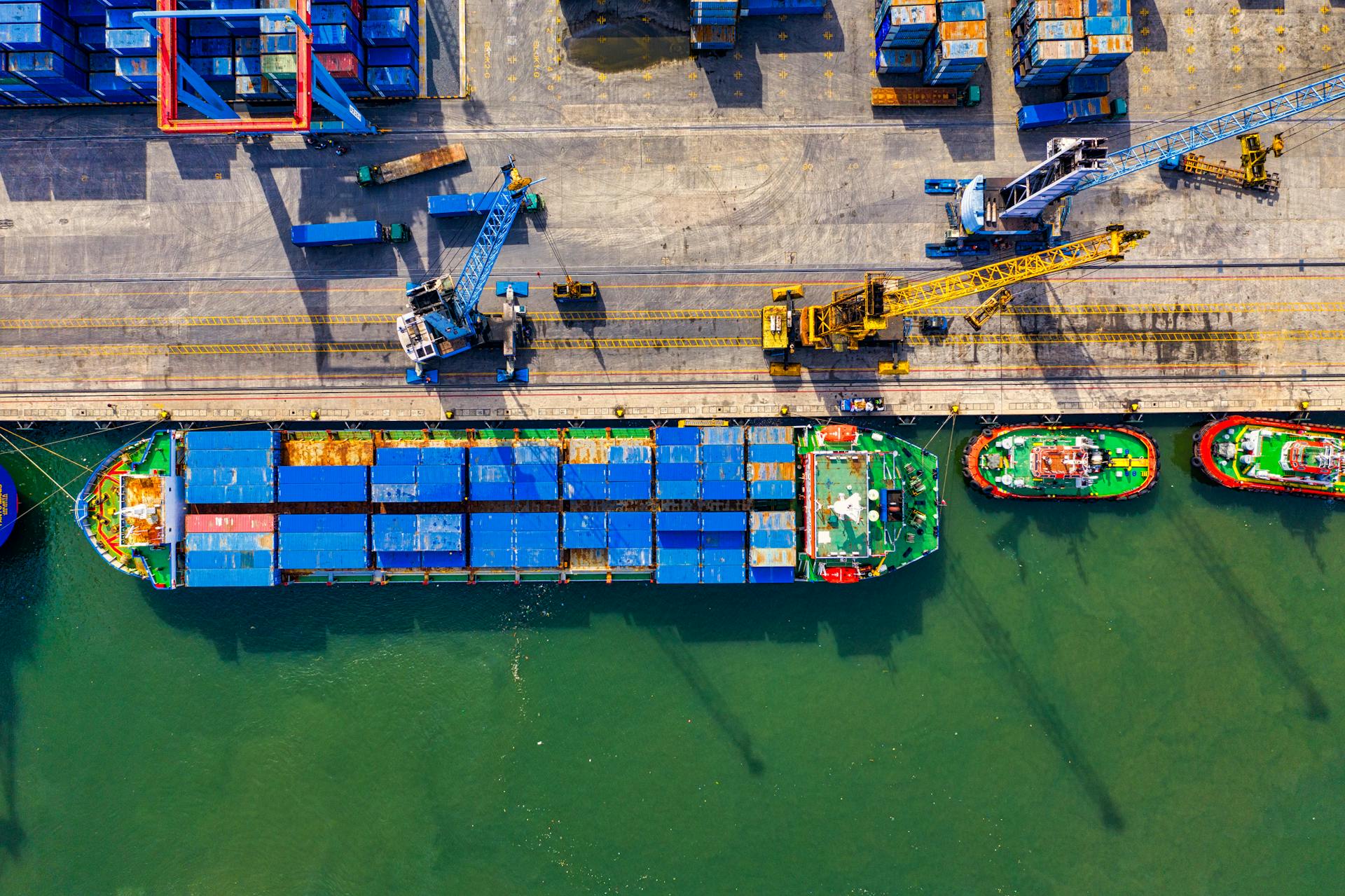

The central message remains unchanged: safety in the Red Sea is still the determining factor. More than two years after diversions via the Cape of Good Hope, following Houthi attacks on commercial vessels, the area is still considered high-risk by carriers.

According to Xeneta, a few isolated transits or signs of improvement will not be enough to trigger a massive return. Lines will wait for sustained stability, acceptable insurance premiums, and clear chartering conditions before making any significant commitments.

Limited Initial Returns, No Market Reversal

Since Xeneta’s December analysis, some carriers have taken cautious steps toward shorter routes. In particular, services announced by CMA CGM using the Suez Canal on full loops have largely been interpreted as tests of improved conditions.

However, subsequent market commentary from Xeneta suggests these moves should not be overestimated. Different carriers are pursuing different strategies, and there is no coordinated or wide-industry return underway. For now, the market remains fragmented, with most capacity still routed via the Cape of Good Hope.

The Risk of a Sudden Capacity Return

One of the most significant risks highlighted by Xeneta is what happens if a broader return begins. Diversions around South Africa added about 10 to 15 days to Asia-Europe transit times, absorbing much of the vessel capacity and tightening supply on key trades.

A large-scale return to Suez would release this capacity relatively quickly. Xeneta warns that if this coincides with the delivery of new container ships ordered during the boom years, the market could rapidly shift from tightness to oversupply—particularly on Asia-Europe routes.

Such a scenario would put immediate downward pressure on spot freight rates and could catch both carriers and shippers by surprise.

Recent weekly market updates from Xeneta reinforce the idea that volatility remains a defining feature of the container market as 2026 begins. Although spot rates have already softened on some lanes, capacity is still constrained by longer routes and network inefficiencies.

The key risk, according to Xeneta, is timing. A change in routing patterns could alter the supply-demand balance within a few months, leaving shippers exposed if contracts were concluded based on very different assumptions.

Contract Strategies Put to the Test

After a long period of irregular services and forced diversions, the potential reopening of the Red Sea would once again reshape the relationship between spot and contract markets.

Xeneta continues to emphasize that flexibility will be crucial in 2026. Increased use of indexed pricing, shorter contract durations, or diversified sourcing strategies could help shippers mitigate the risk of being locked into rates that no longer reflect market realities if capacity conditions change rapidly.

Even if more services begin transiting the Red Sea this year, Xeneta cautions against expecting an immediate return to reliable schedules. Network reconfigurations, vessel rotation changes, and potential alliance adjustments are likely to continue disrupting services during the early stages of any transition.

As a result, shippers may still need to include safety margins in their planning, despite the prospect of shorter transit times via Suez.